The Future of Payroll Factoring Companies: Predictions and Emerging Trends

In the ever-evolving realm of finance, the one constant we can always depend on is change. This principle of inherent dynamism holds equally true for the world of payroll factoring companies, currently undergoing a significant metamorphosis under the irresistible pressure of technological advancements and shifting paradigms of business operations. The future of this sector teems with promise, yet is fraught with challenges which necessitate proactive adaptation.

Payroll factoring, a form of invoice factoring, involves businesses selling their outstanding payroll invoices to a factoring company for immediate cash. The factoring company, in turn, assumes the risk of collection, providing businesses with an injection of cash flow and freeing them from the burden of collections. This transactional paradigm has been a traditional part of business finance, offering a practical solution for organizations grappling with elongated payment terms and the consequential impact on working capital.

However, the landscape of payroll factoring is noticeably shifting, underpinned by the advent of advancements in technology and predictive analytics, changing regulations, and evolving customer expectations. These trends are poised to redefine the trajectory of payroll factoring companies and will shape their business models, operational mechanisms, and value propositions.

The digitization of financial services is one of the most pervasive trends influencing the sector. Emerging technologies such as blockchain, artificial intelligence (AI), and machine learning (ML) are revolutionizing the operational mechanics of payroll factoring. Blockchain technology, with its emphasis on decentralization, transparency, and security, holds transformative potential for payroll factoring. It brings an unprecedented level of trust and transparency to transactions, reducing the risk of fraud and accelerating the transaction pace.

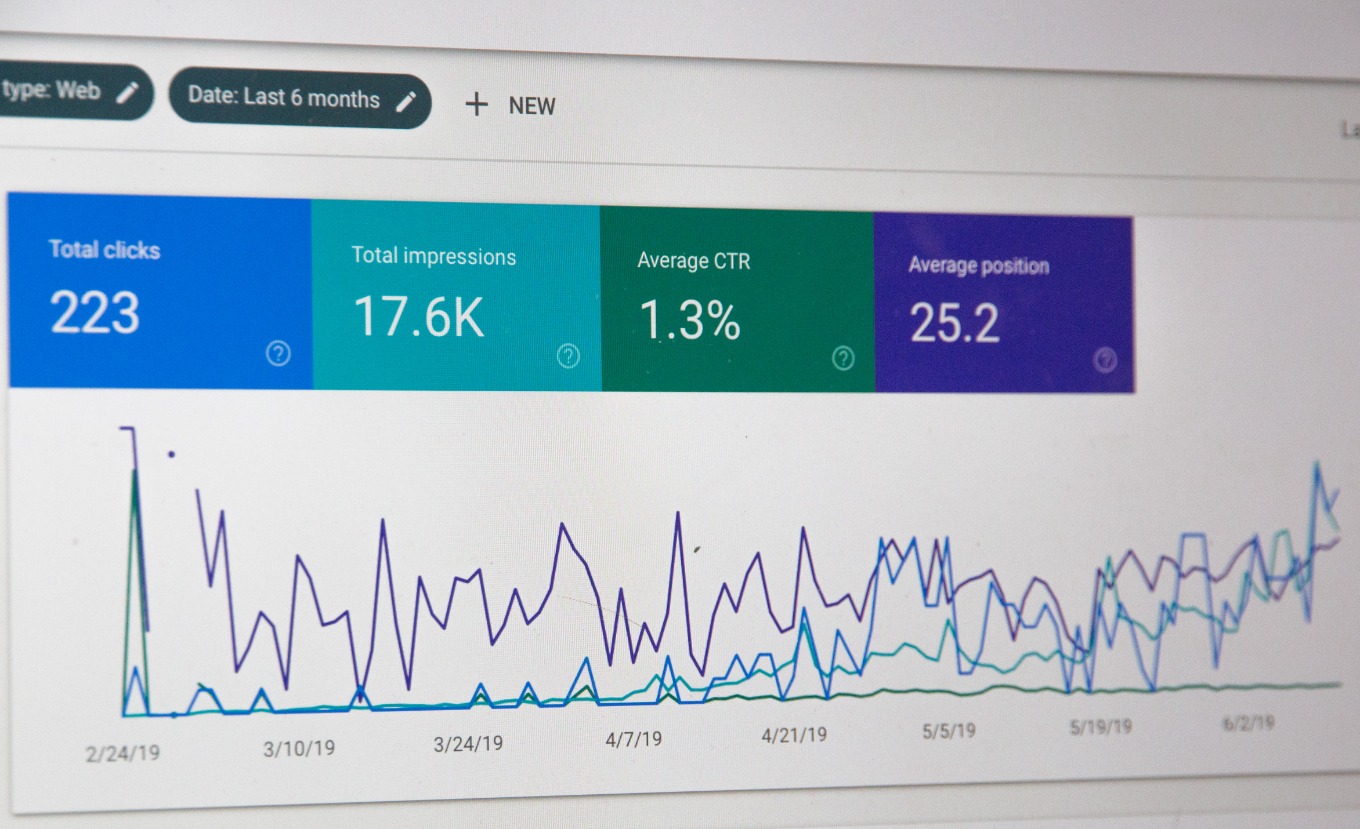

Similarly, AI and ML are being leveraged to optimize risk assessment and decision-making processes. These technologies enable predictive analytics, allowing factoring companies to discern patterns, predict future outcomes, and make data-driven decisions. This enhances accuracy in risk assessment, improving portfolio performance, and ensuring the sustainability of the business model.

However, these technologies are not without their trade-offs. Blockchain, for instance, demands a high level of technical expertise for implementation and operation. Its adoption also requires a paradigm shift in the understanding and acceptance of decentralization. AI and ML, while offering immense benefits, grapple with concerns around data privacy and security. Therefore, the successful adoption of these technologies necessitates a balanced approach that optimizes benefits while mitigating risks.

Another emerging trend shaping the future of payroll factoring companies is the changing regulatory landscape. With increased digitization, regulators worldwide are focusing on strengthening data protection and privacy laws. In the European Union, the General Data Protection Regulation (GDPR) reshaped the way organizations approach data privacy. Similarly, in California, the California Consumer Privacy Act (CCPA) has set new standards for privacy rights and consumer protection. Compliance with such regulations is not a choice but a necessity to maintain the business's integrity and market position.

Moreover, the customer satisfaction paradigm is evolving with increased emphasis on customer experience and engagement. The modern customer values not only the product but also the service experience. Therefore, payroll factoring companies need to prioritize customer-centric strategies, leveraging technology to deliver personalized, efficient, and seamless services.

In conclusion, the future of payroll factoring companies will be defined by their ability to adapt and thrive in the face of emerging trends. Embracing technological advancements, navigating the evolving regulatory landscape, and prioritizing customer engagement will be the cornerstone for sustainable success in this new era of payroll factoring. While the challenges are significant, the opportunities for growth and innovation are abundant. The payroll factoring sector is at the cusp of a transformation, and the future indeed holds promise.

The future of payroll factoring companies will be defined by their ability to adapt and thrive in the face of emerging trends, embracing technological advancements, navigating the evolving regulatory landscape, and prioritizing customer engagement.